- Version

- Download 228

- File Size 163.33 KB

- File Count 1

- Create Date April 8, 2024

- Last Updated May 29, 2024

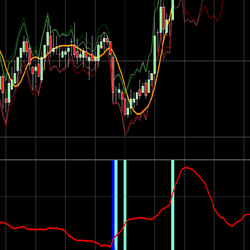

QWT Volatility Indicator

This indicator is extremely versatile and can be used in several time frame charts and even bar charts including range, tick or volume. It works best for instruments like NQ, ES or YM over tick charts. See the real price movement and identify the spikes in the curve plot.

Volatility, in the realm of financial markets, serves as a critical measure of the rate and magnitude of changes in prices over a given time period. It encapsulates the degree of variation in trading prices, with higher volatility indicating larger price swings and, consequently, greater uncertainty or risk. This characteristic makes volatility an essential indicator for traders and investors aiming to gauge market sentiment, manage risk, and identify potential trading opportunities. Especially in the context of derivative instruments like NQ (Nasdaq-100 futures), ES (S&P 500 futures), or YM (Dow Jones Industrial Average futures), understanding volatility can provide insights into underlying market dynamics. By analyzing volatility patterns over tick charts, which represent price changes for a specific number of transactions, traders can discern the intensity of buying or selling pressure and adjust their strategies to either harness or hedge against the anticipated price movements.

Moreover, volatility is not static; it fluctuates in response to a variety of market forces, including economic announcements, geopolitical events, and changes in market participation. These fluctuations can be captured and analyzed through various technical indicators that quantify volatility, such as the Average True Range (ATR), Bollinger Bands, or the Volatility Index (VIX). By applying these indicators across different time frames and chart types—ranging from short-term tick or volume charts to longer-term daily or weekly charts—traders can develop a multifaceted view of market volatility. This approach enables them to identify periods of relative calm or extreme fluctuation, guiding decisions on entry and exit points, position sizing, and stop-loss orders. Ultimately, integrating volatility analysis into trading strategies allows for more informed decision-making, empowering traders to navigate the markets with a clearer understanding of risk and potential reward.